Welcome to Visma eAccounting!

Visma Scanner App

Download the Visma Scanner app on your smartphone, log in with your login details and select Visma eAccounting. Easily take photos of your receipts/invoices and send them directly to the Visma eAccounting company.

You can also choose to email invoices to the unique email address of the Visma eAccounting company. You can find this email address in the app under Settings - Inbound email address. Make sure the "Send directly to accounting software" option is activated.

*More detailed information can be found here.

Activate bank agreement

Easily connect your bank with Visma eAccounting for daily processing of bank transactions and payments. Click here for the steps.

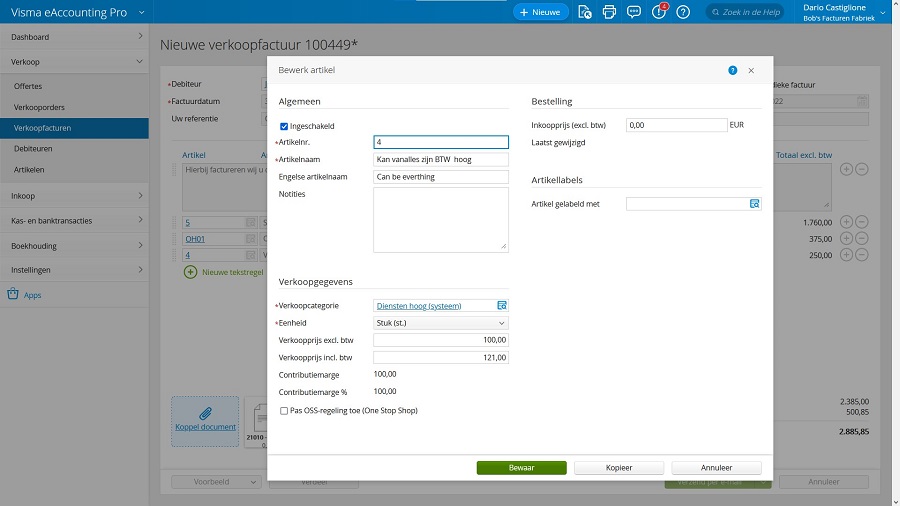

Visma Invoicing

Easily create and send sales invoices as PDF via email or as an e-invoice.

![]()

Visma Financial Overview

For 1 euro per month, Visma Financial Overview Starter (only accessible via the web browser) gives you insight into your figures that your accountant or administration office publishes. In addition, you get access to the online platform where you can store, retrieve and exchange documents with your administration office or accountant.

Would you like to experience even more advantages? For 6 euro per month, you can get started with Financial Overview Standard, which allows you to:

- Create your own dashboards

- Draw up unlimited budgets and forecasts

- Get cumulative totals of periodic amounts

- Get insights into KPIs to measure your performance.

Want to make use of Visma Financial Overview Starter or Standard? Then please contact your administration office or accountant.

Take advantage of the additional options!

Such as:

- Book your purchase invoices yourself

- Process your bank transactions yourself

- Prepare your VAT return yourself.

Do you have questions? If so, please contact your accountant.